Agreed Value Car Insurance Malaysia

Land rover defender agreed value insurance. As its name suggests agreed value is a property value that you and your insurer agree upon at the beginning of your policy period.

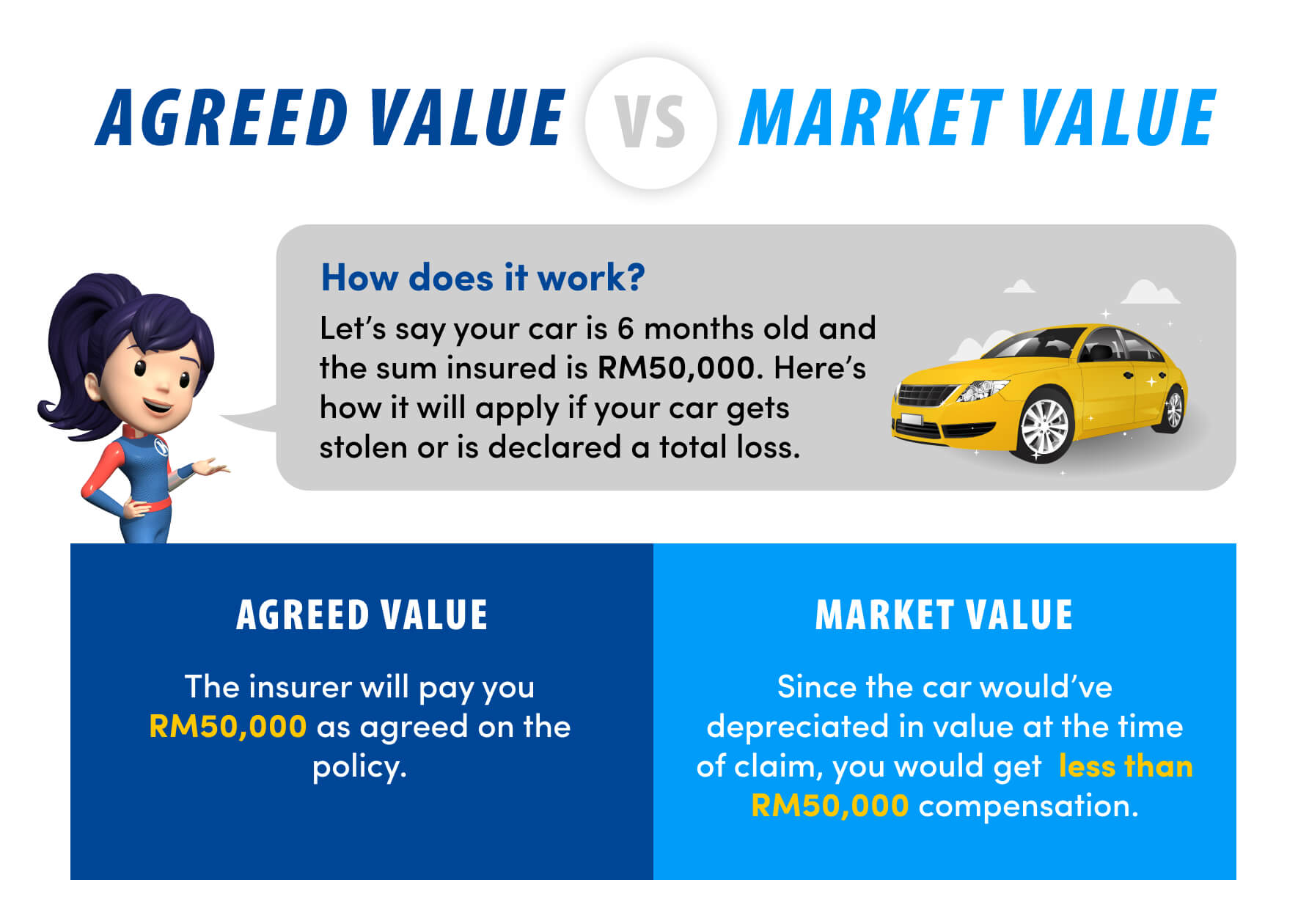

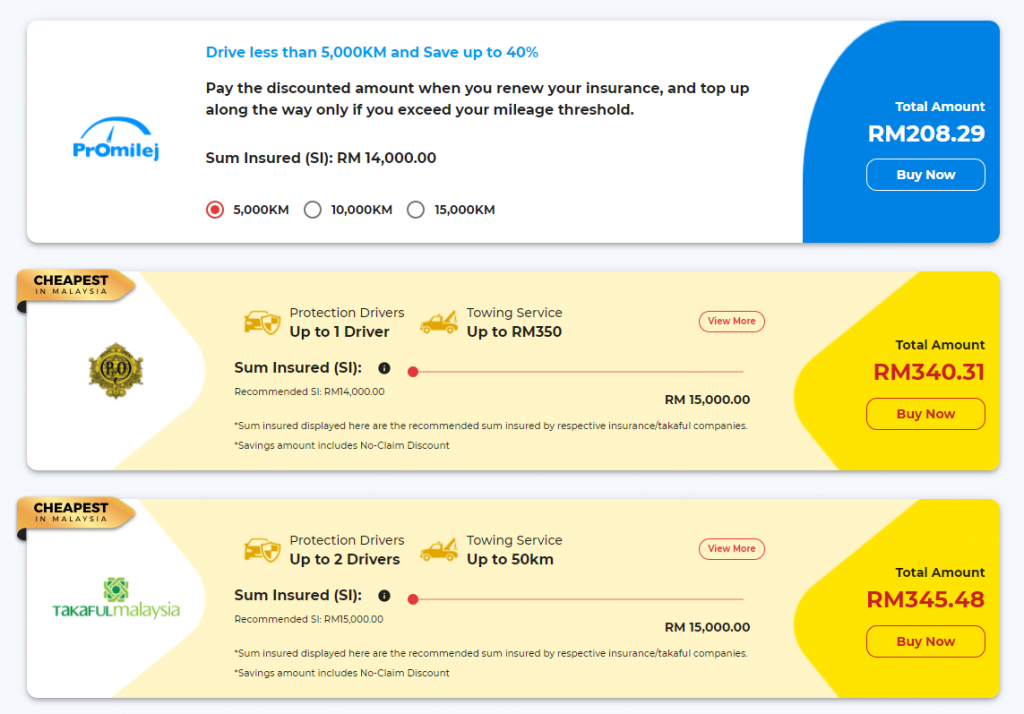

Agreed Value Vs Market Value In Car Insurance The Difference

Agreed value is frequently done by owners of classic vehicles antique show cars and collector cars.

. The premium due must be paid and received by Zurich General Insurance Malaysia Berhad before cover commences. If your car is involved in an accident that causes damage or loss amounting to RM20000 your insurer can only cover half of the cost as agreed in the policy which is RM10000 sum payable. Its mainly for cars that are worth more than the average for a similar age model.

Your car starts to depreciate after you receive it from the dealer. What is the difference. Vehicle Market Value The current browser does not support Web pages that contain the IFRAME element.

Land rover defender agreed value insurance Related Articles. This insurance cover is automatically null and void if this condition is not complied with. Market Value as its name suggests is based on the calculated worth of the vehicle at the time.

Accidental or fire damage to your vehicle. Well reimburse you the market valueagreed value of your car in the event of theft or total loss caused by fire. Anyone can buy a car insurance policy based on agreed value rather than actual cash value.

Theyre useful for classic cars that have held or increased their. Read the latest contents about land rover defender agreed value insurance in Malaysia Check out Latest Car News Auto Launch Updates and Expert Views on Malaysia Car Industry at WapCar. Liabilities to other parties for injury or death.

Kenderaan anda bernilai rm100k sekarang. To obtain coverage based on an agreed value you must submit a statement of values to your insurer before your policy begins or renews. Harga Semasa Market Value Menginsuranskan kenderaan mengikut harga pasaran atau dipanggil Market Value adalah terjemahan mudah.

Agreed value car insurance policies pay out a pre-agreed sum in the event of a total loss. It is a plan which covers you for. Pls explain why for my cars RM25K agreed value car you charged me RM125 at 05 rate but only covered flood hail and tempest and not landslide earthquake etc.

It refers to the amount of car value an owner will lose over time. Diinsuranskan pada kadar rm100k. Like for example my sum insured in 2019 is 80k then this year quotation came for 2020 is still 80k.

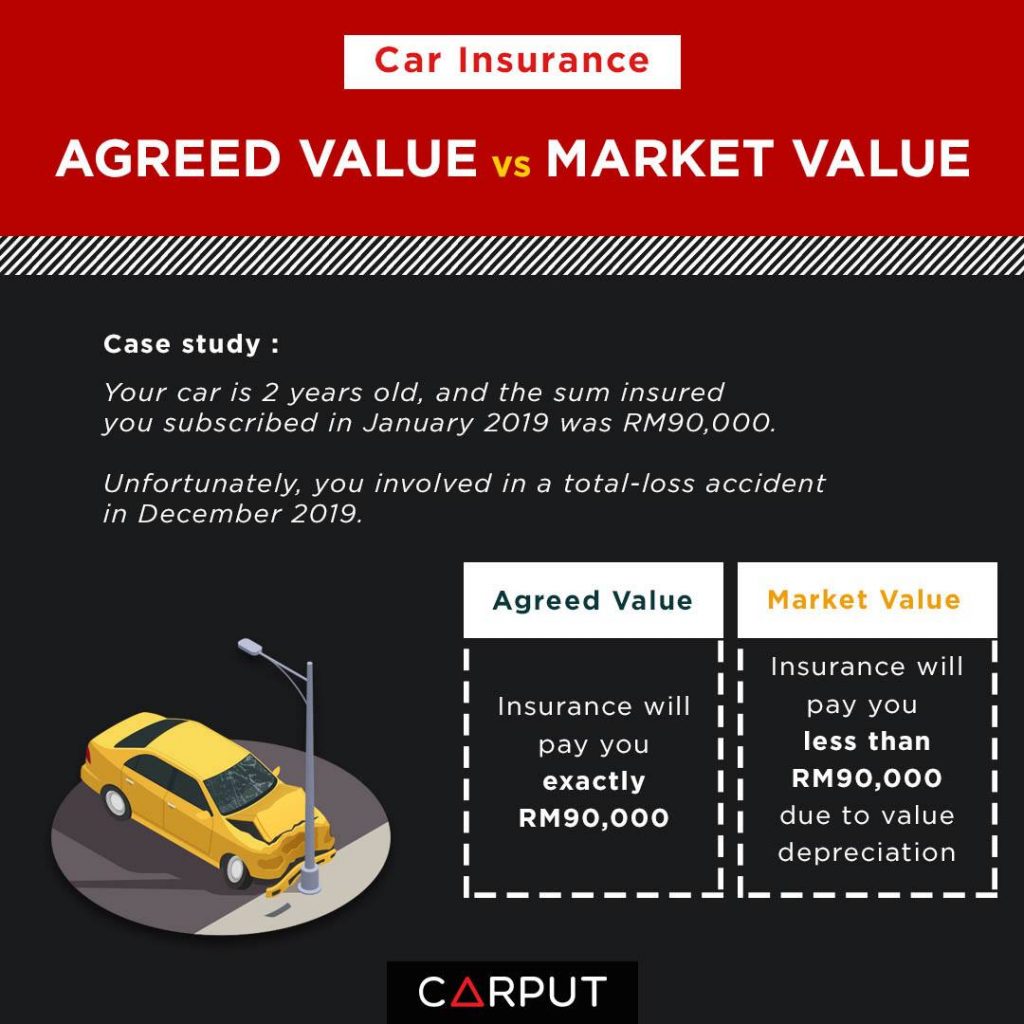

Seandainya kenderaan anda terlibat dalam kemalangan yang berakhir dengan status total loss kiraan gantirugi akan. The total compensation value depends on either the market value or sum covered whichever is the lower at the time of the loss. E-Hailing Private Hire Car- Daily Non-tariff only applicable to Comprehensive Private Car Policy.

Many factors may contribute to a car depreciation but it is most likely due to natural wear and tears. 8126 December 15 2021. Edelweiss General Insurance goes bullish on Open API IT News ET CIO December 16 2020.

You insure your car for half of the market value at RM40000. Agreed value is a fixed amount on which you and the insurance company agree upon while purchasing a new or renewing an older insurance policy of your vehicle. DEAD LUCKY Indonesian coffin maker becomes instant millionaire after 18million SPACE.

Car Market Value Guide Obtain an up-to-date valuation for your vehicle using CarBasemy Car Market Value Guide. Motor insurance is a compulsory class of insurance for all vehicles licensed to be used on public roads as per the Road Transport Act 1987. What is agreed value.

Car depreciation is the difference in the value of a car between the time you purchase and when you sell it. Increase in digital platforms Covid-enforced mindset is changing Malaysias insurance landscape February 5 2021. Theft of your vehicle.

If a claim is made by you in the future the insurance company will be liable to compensate you with the fixed amount you both agreed upon without any questions asked. This valuation is meant as a guide only. 11 The current market practice of insuring motor vehicles without reference to any vehicle valuation database has not only given rise to over-insurance or under-insurance by consumers but also disputes on market value of vehicle at the point of loss.

Guidelines concerning Market Value. To use this Web Part you must use a browser that supports this element such as Internet Explorer 70 or later. If you dont have an agreed value when insuring your vehicle your car insurance will be based on the actual cash value.

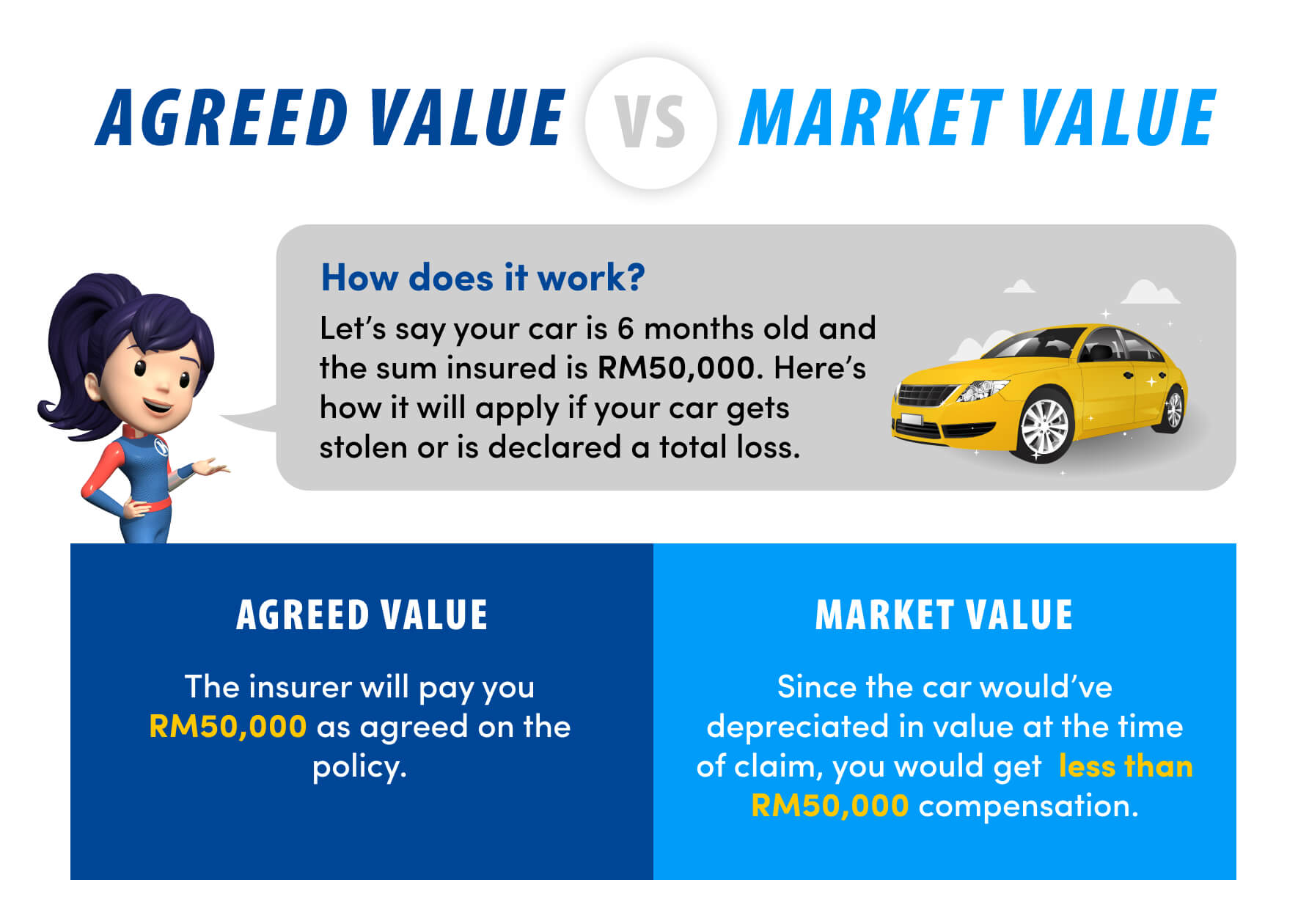

This is where an Agreed Value vs Market Value of an insured sum comes into view when your vehicle is declared a total loss or has been stolen. They pay out an amount youve both agreed on for your car if its written off or stolen rather than the average market value for it. Keep those journeys going with AIG Car Insurance - awarded Malaysias.

Loss amount payable RM40000RM80000 x RM20000 RM10000. Actual values may vary between RM2000 - RM5000 depending on the condition of the. Use this valuation to find out how much a car is worth for either purchase sale or for insurance renewal.

But when total loss before renew insurance they. Assuming you have insured your 2015 Perodua Myvi at. Issued By Bank Negara Malaysia 1.

Understand the Agreed Value Option. Just make sure you lodge a police report immediately. Why got concept like agreed value and market value when u do total loss claim stars.

If the market value of your car is RM80000 and the sum covered you have selected is RM70000 then the total compensation value is RM70000.

Car Insurance Difference Between Agreed Value Vs Market Value Carput

What Is An Agreed Value Vs Market Value In Car Insurance

Car Insurance Difference Between Agreed Value Vs Market Value Carput

0 Response to "Agreed Value Car Insurance Malaysia"

Post a Comment